Chart of the Day

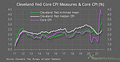

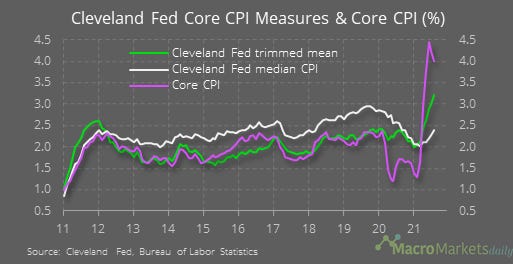

One of the big debates in macro right now is whether the spike in US inflation will be transitory, or whether higher inflation is here to stay. The August inflation data had some encouraging signs for Team Transitory, with core inflation dropping by 0.2%-points more than economists had forecast, to 4.0%. Yet as this chart shows, two alternative measures of core inflation from the Cleveland Fed, the trimmed mean and the median CPI, increased. Those measures are supposed to be better designed to avoid volatile, and potential transitory movements, in individual components. So their continued increases mean we still need to be on the watch for signs inflation will remain higher than many people expect.

Macro

Headline inflation did not fall as much as core, in part because of higher natural gas prices pushing up the energy CPI.

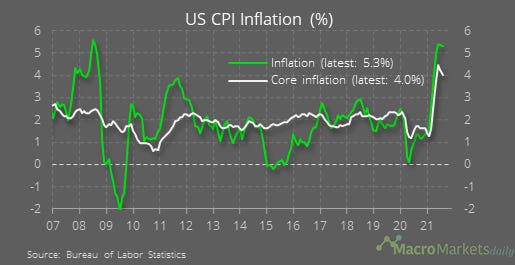

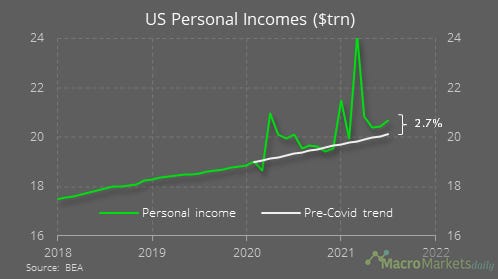

The Fed is getting plenty of flack from economists who note that the consumer price index is now 2.4% above the pre-Covid trend.

Consumers’ incomes are also above their pre-Covid trend though, and incomes were boosted last year by the stimulus checks - that’s part of the reason inflation has risen so much more in the US than elsewhere.

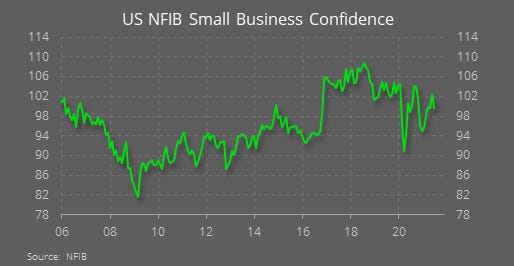

US NFIB small business confidence fell by 2.8 points to 99.7 in July, and is now below the pre-Covid level again.

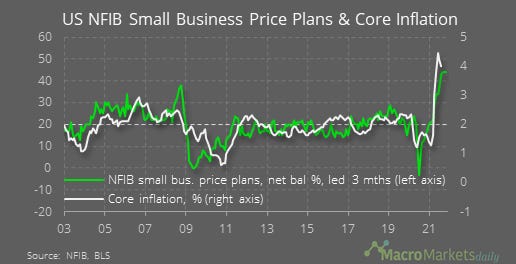

Small businesses' price expectations suggest core inflation will remain quite high for now.

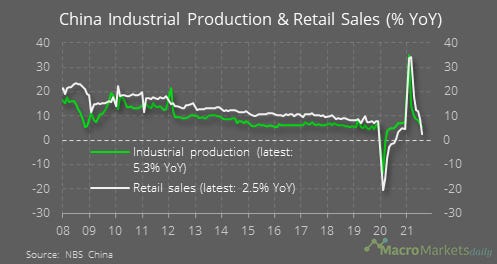

There was a huge miss on China retail sales in August - economists thought growth would be 7% YoY, instead it was 2.5%.

Markets

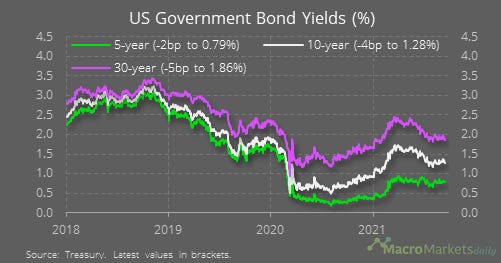

The inflation data coincided with declines in US bond yields, especially at the long end of the curve.

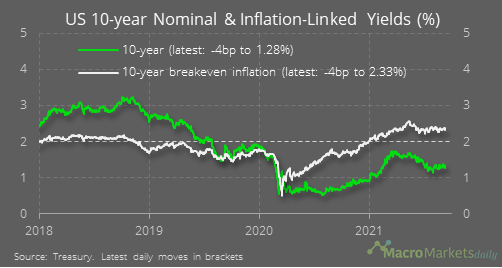

That was entirely due to a drop in the breakeven inflation rate, suggesting the weaker-than-expected inflation in August lowered long-term inflation expectations too.

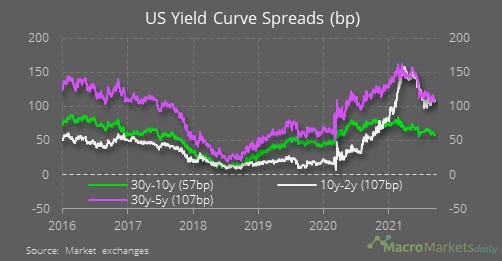

The US yield curve remains much flatter than at the start of the year. There’s plenty of debate about whether the Fed’s soon-to-come QE tapering could reverse that trend, by raising bond supply and pushing up long-term rates, or exacerbate it, by further lowering inflation expectations due to tighter monetary policy. We’ll see…

Like what you see? Please forward this email to your friends and colleagues, or use the button below to share it on social media. They can also follow us https://twitter.com/macro_daily