Chart of the Day

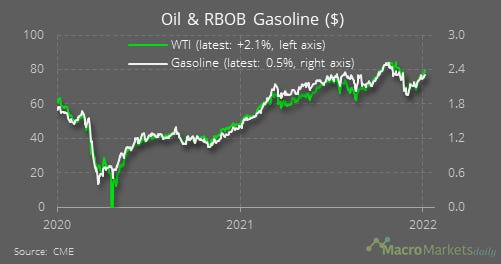

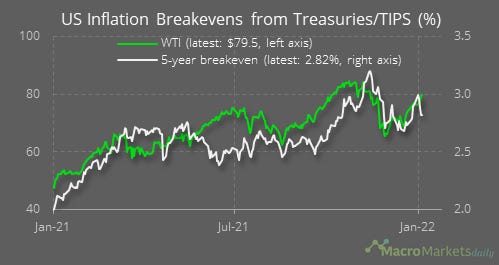

Earlier this week OPEC announced that it would continue to raise oil output in the coming months, but that hasn’t stopped oil prices from increasing. Many media reports have argued that this is because OPEC’s decision to raise supply demonstrates that demand must be very strong. That sounds a bit like journalists are clutching at straws to explain the move, but there probably is some truth to the idea. Prices slumped after Omicron fears spread, but with some countries such as the US doing relatively little in the way of new restrictions, demand probably won’t fall as much as some feared. The other issue is that some OPEC producers are struggling to raise output above their existing production levels, meaning that OPEC’s plans to raise output probably won’t be met in full, at least not any time soon. The big question is whether oil prices keep rising past their prior peak - if they do, then it’s going to take even longer for inflation to come down again, and rising prices will put further pressure on the Biden administration ahead of the midterms this year.

Macro

The US November trade data showed exports rose by 0.2% MoM and imports increased by 4.6% MoM, causing the trade balance to drop back sharply again toward a record low, at least in dollar terms.

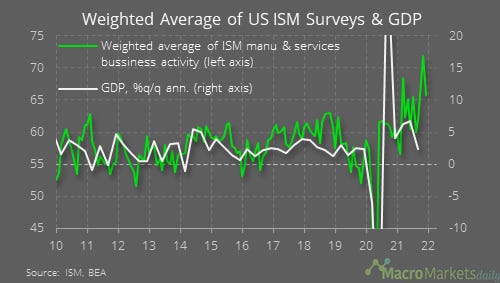

A weighted average of the ISM surveys fell to 65.8 in December, which is still much higher than in the years before the pandemic.

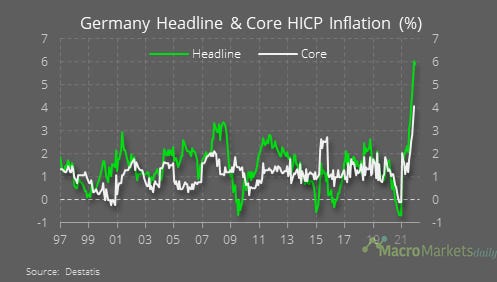

The early German data showed inflation fell in December, we have to wait for the final release to see how much was driven by core inflation.

Markets

The S&P 500 fell by 0.1% yesterday, it's still a touch above its 50-day MA which has previously often served as the point for a reversal.

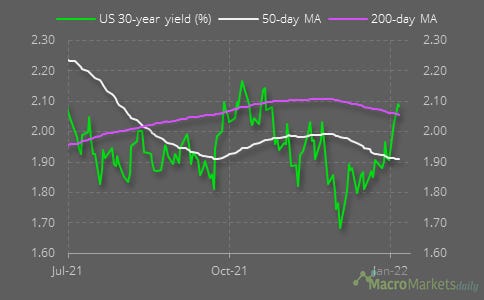

The US 30-year yield is now back above its 200-day MA

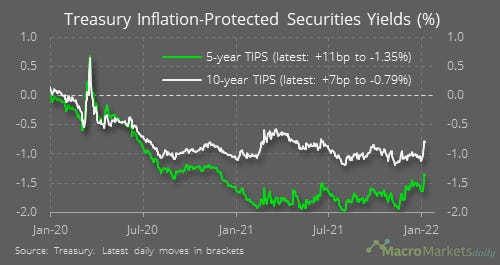

Real yields continued to rise on Thursday.

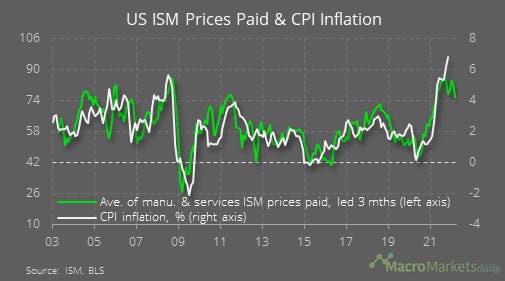

With the Fed taking a more hawkish approach, the rise in real yields has pulled down inflation breakevens, even as oil prices have risen

Lumber prices have been rising strongly again, partially due to the Biden administration’s decision to put new tariffs on imports from Canada - those home improvement projects will get more expensive, and this will put more upward pressure on new house prices.